If you find trading in the Foreign Exchange market enjoyable and are keen to take your trading abilities further, you may be interested in learning about Evaluation trading.

This could be a valuable next step in your trading journey. Evaluation Trading has been gaining traction among Forex enthusiasts, given its potential for higher capital trading volumes and the subsequent possibility for increased profits.

It is indeed essential to grow and maintain your personal trading account. Yet, many traders start with limited funds, which frequently results in blown accounts.

Evaluation trading offers an excellent chance for these traders to earn and simultaneously increase the funds in their personal trading accounts.

This blog pivots on the advantages that Forex Evaluation Trading presents and the transformative impact it can have on your personal trading pursuits.

Table of Contents

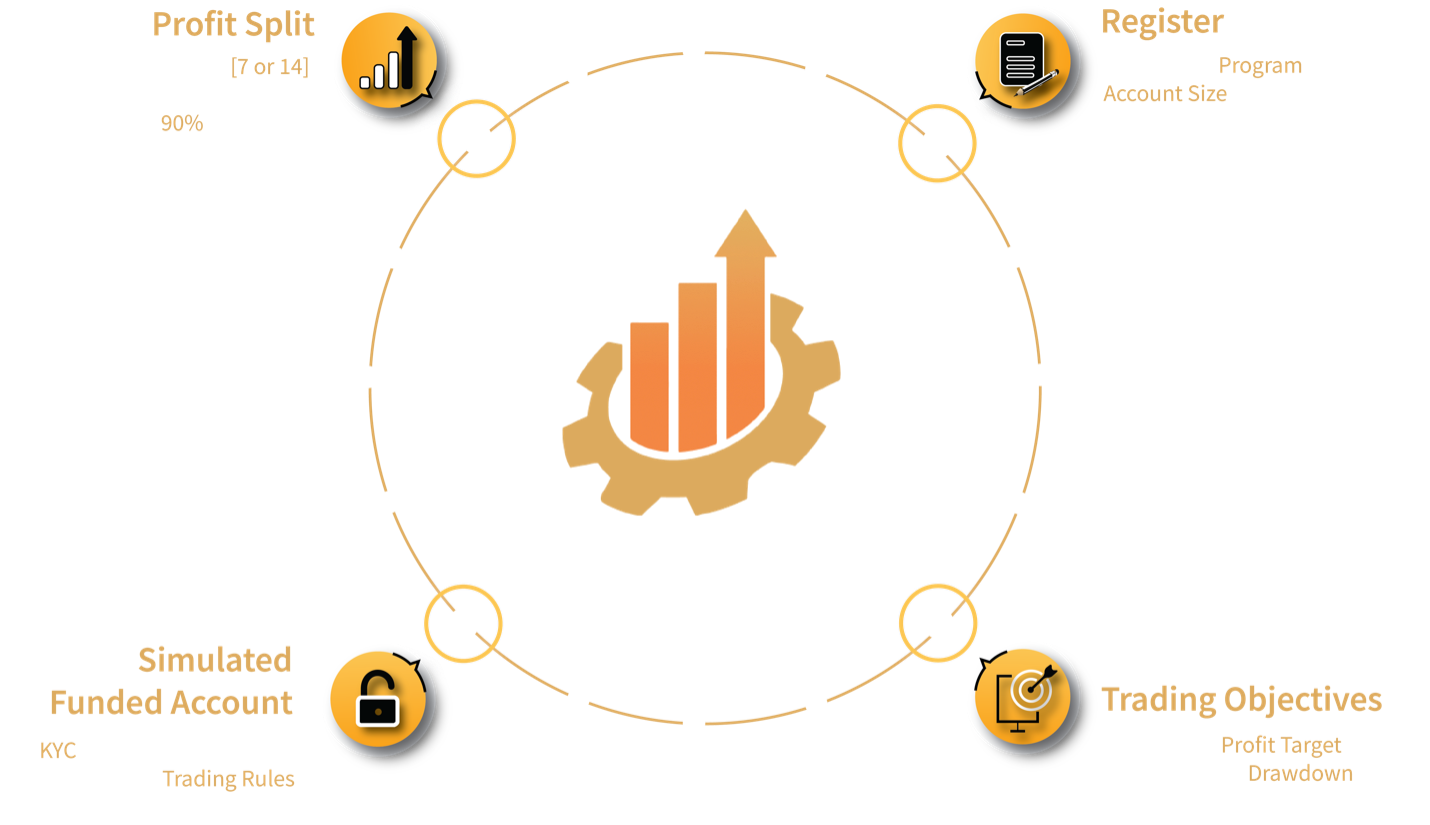

Understanding the basics of Forex Evaluation Trading

Forex Evaluation trading enables individuals to trade with a higher capital (simulated) thus offering greater potential for substantial profits.

The potential of generating exceptionally high returns outweighs the costs of any challenges purchased.

These firms furnish traders with access to sophisticated trading tools, platforms, and real-time market insights, which aid in making well-informed trading decisions.

Evaluation firms offer a range of account sizes.

At Funded Engineer, we offer Account sizes from $6,000 to $300,000, along with different programs such as 1-step and 2-step challenges to suit your trading style.

The potential returns on larger accounts can greatly boost your earnings, a result that is often challenging to achieve with smaller, underfunded accounts.

Yet, it’s crucial to adhere to the established trading rules and objectives.

Typically, the Profit target falls between 8-10%, while the Daily drawdown limit usually ranges between 4-5%.

Additionally, the total drawdown limit often ranges from 8-12% within the Retail Trading Industry.

Now let us proceed by delving into the advantages of Forex Evaluation Trading:

Evaluation Accounts provide access to higher trading capital

Forex Evaluation trading provides the significant advantage of utilizing larger amounts of capital.

This is especially beneficial for traders whose own resources may be limited.

By having a Simulated Funded account at an evaluation firm, traders can hold bigger positions in the market while maintaining the same risk management strategy, which can lead to substantial profits.

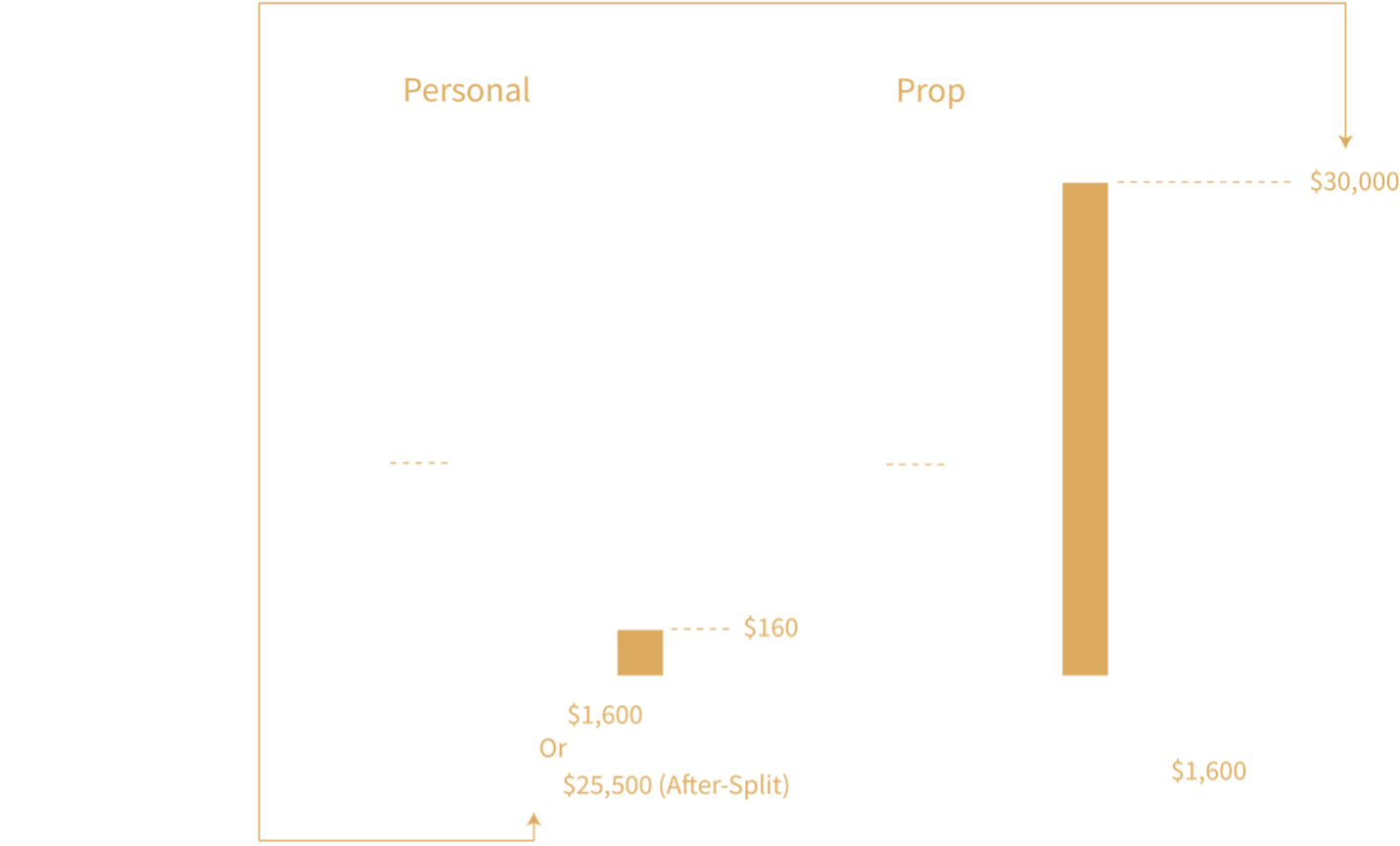

Consider a trader with a personal trading account of $1,600 (equal to the purchase price for a $300k Standard Challenge account at Funded Engineer) who achieves a consistent monthly profit of 10%, equating to $160.

If the same trader applies their strategy to a $300,000 account provided by an evaluation firm, the profit could soar to $30,000 monthly – an approximately 190-fold increase compared to the return on a personal trading account.

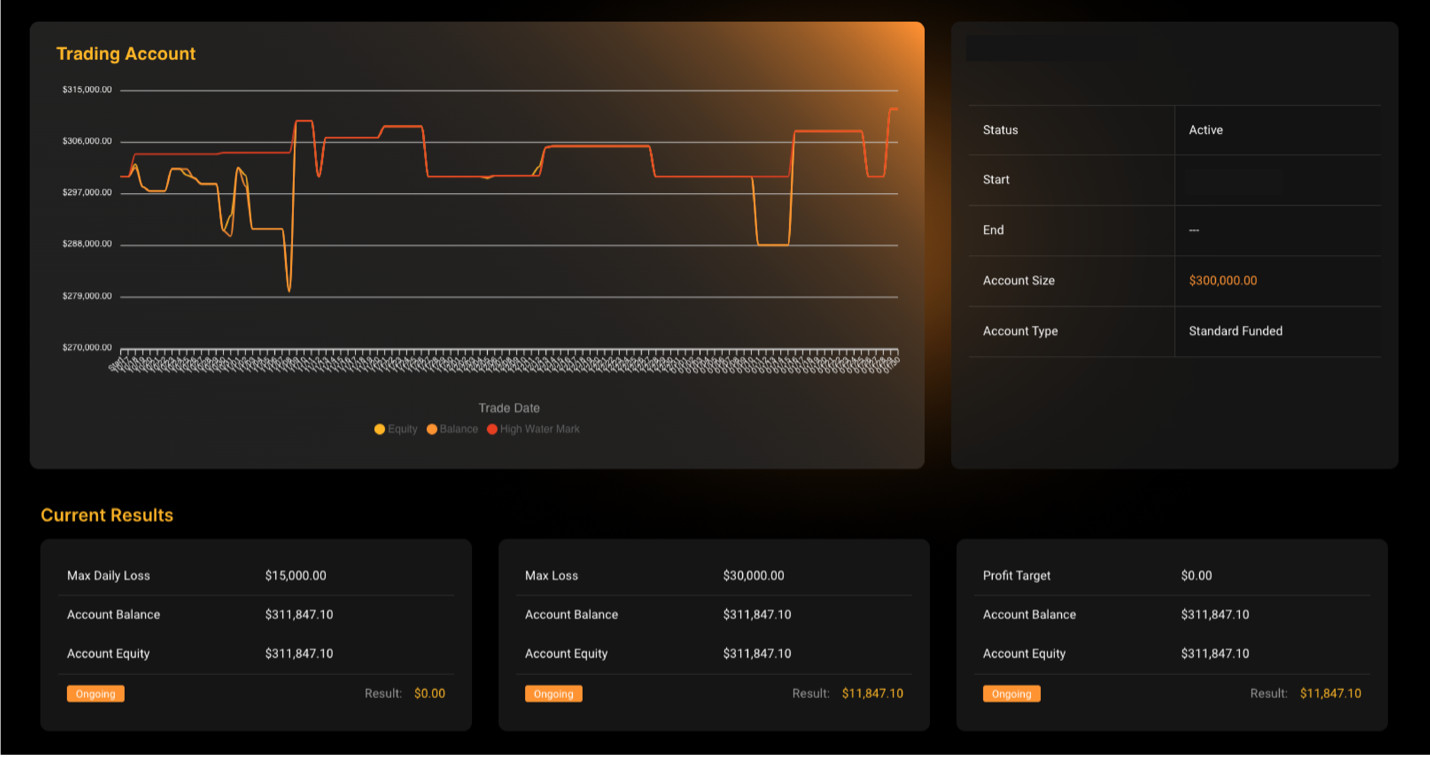

Let us take an example of a trader at Funded Engineer who secured a simulated $300,000 Standard Funded account: (Account number and Name have been removed to respect privacy)

An example of this benefit in action is this trader who generated a return of $11,847.10, reflecting a mere 3.94% return on the original account balance.

Such access to higher capital can yield exponentially greater return for a significantly smaller cost which is only the purchase fee of the challenge account of $300k.

Moreover, without setting risk limits, traders could potentially over-leverage, risking the entire account.

Evaluation firms mitigate this by ensuring that the trader’s maximum financial risk is the initial fee to access the account.

This structure enables traders to minimize potential losses while maximizing gains. Traders are always focused on Risk-to-Reward after all.

The example provided underscores the value of nurturing your own trading account.

While evaluation firms present a solid avenue for earning profits, they also serve as a stepping stone for enhancing your personal trading funds.

Instead of beginning with just $1600 in your personal account, using an evaluation firm’s resources can substantially increase it, especially if you reinvest your earnings back into your personal trading account.

Establishing Trading Discipline and Risk Management

Evaluation Firms are known not just for the higher access to Capital they offer but also for instilling trading discipline via stringent risk management protocols.

It’s a well-known fact that a large percentage of individual traders — around 90% — end up depleting their trading accounts.

Evaluation firms help to reverse this trend by setting firm daily loss limits, which encourages traders to adopt sound risk management practices.

This approach assists traders in minimizing losses and achieving consistent profits.

This in turn also significantly enhances the management of personal trading accounts.

Rewarding Traders showcasing Good Trading Skills

Evaluation trading firms incentivize skilled traders by presenting additional rewards, such as account Scaling plan, which:

- Allows traders to incrementally increase their account balance.

- Offers an increase in the profit split.

- Offers an Increase in Allowed Drawdown

This system not only motivates traders to perform their best but also provides a clear pathway for financial growth.

Professional Development and Support

Simulated trading offers an excellent platform for traders to hone their trading abilities.

They grant access to a variety of educational resources, enabling traders to refine their skills and discover new trading tactics.

Funded Engineer, for instance, boasts a dedicated blog space filled with valuable educational materials that traders can use to broaden their trading knowledge.

Moreover, these firms often have support available around the clock, ready to respond to inquiries.

This can be particularly beneficial for novice traders who are navigating the complexities of the industry for the first time.

By offering tools for analysis such as Account Metrics, evaluation firms provide traders with the analytical edge necessary for successful trading.

Below is an example of a Trader’s account dashboard at Funded Engineer:

Trader’s Account Dashboard serves as a constant checkpoint for traders to assess their trading metrics comprehensively.

It provides a detailed rundown of crucial statistics that are instrumental in evaluating trading performance.

The Account Dashboard showcases various performance indicators such as the win rate, daily profit and loss figures, cumulative earnings, daily trade count, preferred trading instruments, and the average profit per transaction.

By regularly reviewing these analytics, traders can pinpoint weaknesses in their strategies and make informed adjustments to improve their trading approach.

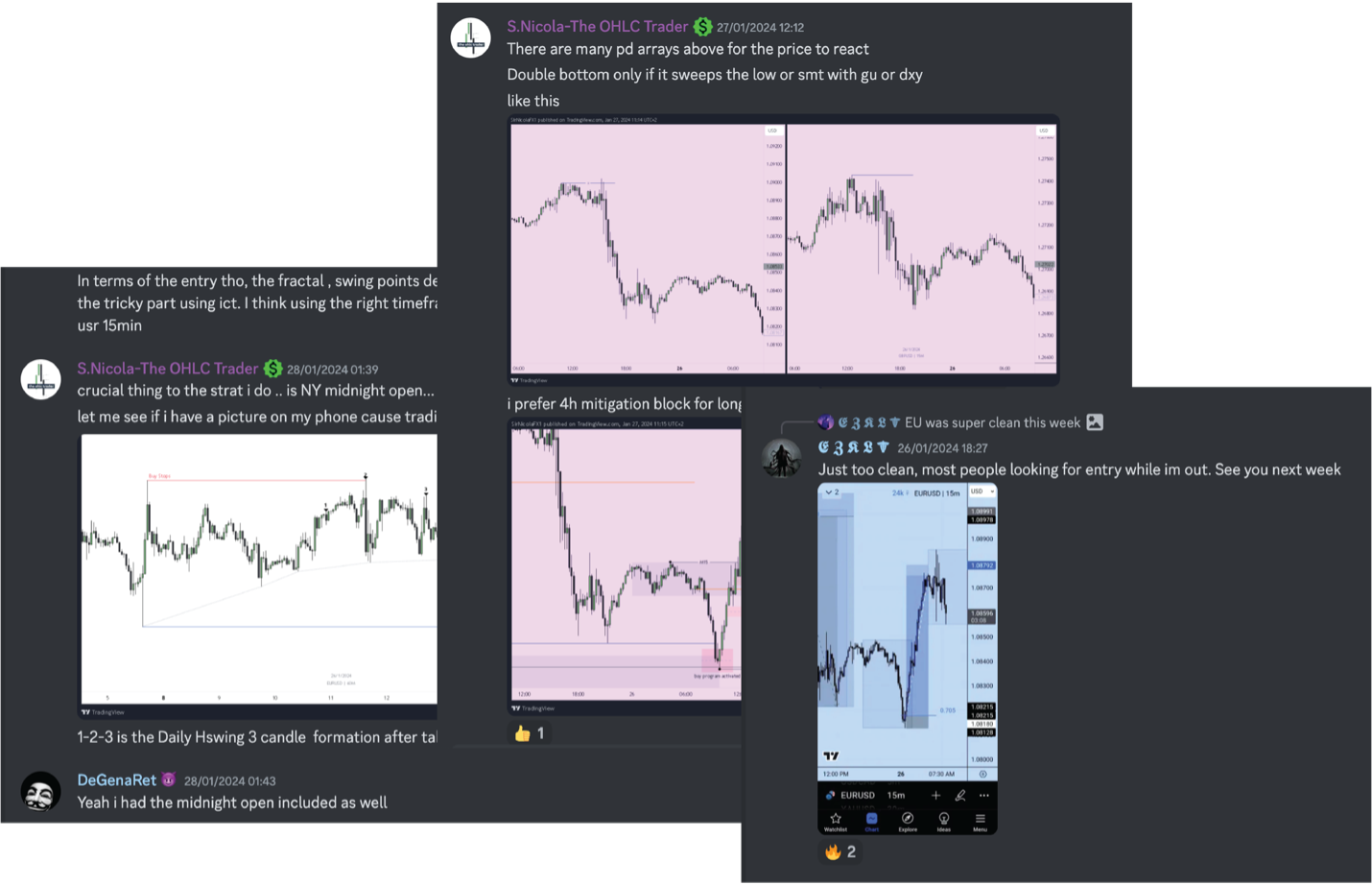

Be a Part of the Trading Community

Engaging with an evaluation firm creates an environment for exchanging trading insights, comprehending the challenges and successes of colleagues, and leveraging these experiences as a learning tool for professional development.

You can join the discord server of Funded Engineer and be a part of the passionate and helpful trading community.

To Wrap Up

From significant capital resources, potential for high returns, and disciplined framework, these firms are integral in helping traders refine their strategies and elevate their trading game.

Evaluation firms are instrumental in fostering continuous improvement and consistent performance.

Here’s a recap of the key points discussed in this blog.

What are the advantages of Evaluation Firms?

The advantages of Evaluation Firms include access to greater capital, structured risk management protocols, advanced trading tools, and professional educational resources.

They also offer the potential for higher profits and provide opportunities for growth through performance-based incentives like increased profit splits and account scaling

Is Trading for an evaluation Firm worth it?

Becoming part of an evaluation firm can be beneficial since it offers substantial trading capital and aids traders in developing risk management expertise.

The main reason why it is always worth a try is due to the potential of extremely large gains with little cost of just program fees.

Do Evaluation Firms give real money to trade with?

All trading is done on a simulated (virtual) funded account. At no point does a trader trade on real live funds or act as an investor. The entire process is confined to a simulated environment.

How Profitable is Simulated funded Trading?

Simulated funded trading can be highly profitable, as it allows traders to leverage substantial simulated capital provided by the firm, increasing their potential for larger gains.

The profit share goes up to 90% for most of the existing evaluation firms as well.